how much will my credit score increase with a car loan

As a result the amount you owe will reflect as 0 which could lower your score. The answer potentially a lot.

You will likely pay a 560 monthly.

. It all depends on how you manage the loan how much the loan is for and how you honor the commitment. This is due to the hard inquiry from the credit check and the new loan being reported to the credit bureaus. Will financing a car build credit.

Click Now Apply Online. When you take out an auto loan especially a bad credit car loan you gain the. As part of your income your federal student loan forgiveness balance may increase your tax bill but may not be enough to push you into a higher tax rate.

Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. Experts have stated that your credit score will begin to improve within just a few months after paying off your car loan. However its normally temporary if your credit history is in decent shape it bounces back.

Too many accounts reporting a balance also dings your scores. If you manage the repayments. But if paying off a car loan decreases your average account age.

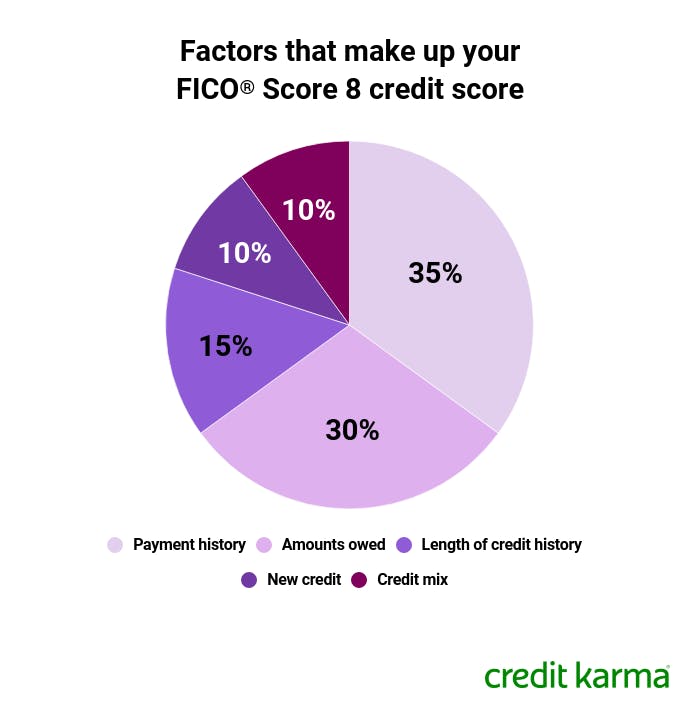

The biggest piece of the pie is payment history making up 35 percent of your credit score. If you already have a credit score in the 800s and you make payments on a car loan it wont increase much. Once you pay off a car loan you may actually see a small drop in your credit score.

Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. Additionally FICO considers length of credit history a component in your credit score. How much can you get with a credit builder loan.

Lenders usually decide upon loan approval based on your credit score. Ad See Your Score in 3 Simple Steps. Ad View your latest Credit Scores from All 3 Bureaus in 60 seconds.

In the event of a financial setback refinancing will reduce monthly auto loan payments. It may come to you as no surprise that making payments on your car will improve your credit score. Timely Car Loan Payments The most important factor in your credit score.

No Credit Card Required. 15 of your score comes from the length of your credit history which refers to the age of your oldest reported account the average ages of all of your accounts and other time. Heres a look at the national average auto loan APRs as of Dec.

For example you put 10 recurring charge on each of your 5 cards and set them to autopay. If you make payments on time your credit score will grow. Paying off a car loan can allow more breathing space by reducing your.

A new auto loan may lower the average age of all your accounts The length of your credit history and the average age of your accounts make up 15 of your FICO score. Point it in the Right Direction with CreditCompass. If you have a FICO Score of 720 or higher.

If you already have a credit score in. Click Now Choose The Ideal Auto Finance Service For You. Score sees 100 of.

Throughout your life you build a credit score which can change over time. In fact your payment history has the largest impact on your credit score. Get Score Planning Report Protection Tools Now.

Youre not alonemany people with car loans question when to pay it off. For example if paying off a car loan bumps your average account age from four to six it could boost your score. Granted this method will make the auto loan drag on longer but at least.

Ad Read Expert Reviews Compare The Best Auto Finance Options. Just continue to make all of your other credit card and loan payments. Here is how its calculated.

How much your credit score will increase is determined by your starting point. Get An Instant Loan Approval With Options Including Low Payments - Apply Now. Get An Instant Loan Approval With Options Including Low Payments - Apply Now.

Ad Increase your FICO Score Get Credit for the Bills Youre Already Paying. 425 75 votes When you apply for a car loan lenders will pull a hard inquiry on your credit reportto see your credit history and assess your creditworthiness to. First your credit score drops by a few points temporarily.

However the specific amount your score changes depends on your debt load and unique credit profile. Build or rebuild your credit rating as you build savings. You Can Increase your FICO Score for Free.

Ad Fast 5000-51000 Loans For a NewUsed Car. Borrow from 500 to 3000 for 12 to 24 months. Your Credit Can Too.

How much your credit score will increase is determined by your starting point. Answered on Dec 15 2021.

What S The Minimum Credit Score For A Car Loan Credit Karma

What Credit Score Do You Need To Get A Car Loan

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Credit Score

What Is Considered A Good Credit Score Good Credit Score Good Credit Credit Score Infographic

People Have Been Asking How Come When I Apply For A Home Loan Or A Vehicle I M Not Approved My Credit Score Is A 7 In 2022 Short Answers How

5 Top Methods To Raise Your Credit Rating Fast Credit Score Credit Repair Paying Off Credit Cards

What Is Considered Bad Credit Legacy Auto Credit

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Score Credit Repair Business Credit Repair

What Credit Score Do You Need For A Car Loan Loans Canada

Decoding The Factors That Determine Your Credit Score Infographic Daily Info Credit Score Infographic Good Credit Credit Repair

Does Financing A Car Build Credit

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

How To Get A Car Loan With Bad Credit Forbes Advisor

What S The Minimum Credit Score For A Car Loan Credit Karma

What Is The Minimum Credit Score For A Car Loan 2022

Missing Payments Accruing More Debt Than Income And Applying For Or Canceling A Lot Of Credit Cards Will Negative Car Loans Credit Score Improve Credit Score

What S The Minimum Credit Score For A Car Loan Credit Karma

How To Get A Car Loan With Bad Credit Carloan Badcredit Loans For Bad Credit Bad Credit Car Loans